SBI Wrote Off Bad Loans Worth Rs 76,600 Crore of 220 Defaulters Who Owed Over Rs 100 Crore Each

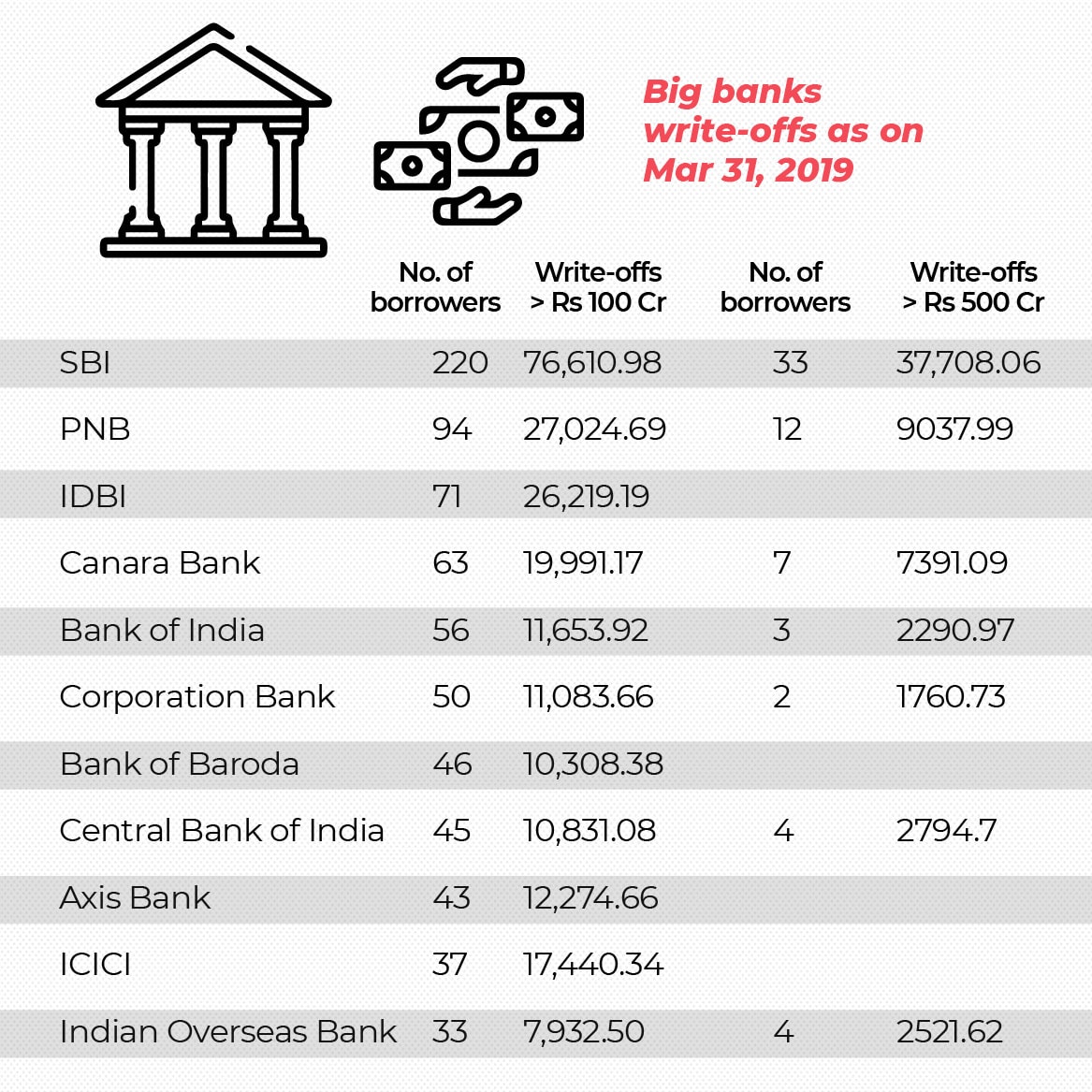

New Delhi: State Bank of India (SBI), India’s largest bank, has written off bad loans worth Rs 76,600 crore of 220 defaulters who owed more than Rs 100 crore each.

As of March 31, 2019, the SBI has declared as unrecoverable outstanding worth Rs 37,700 crore that 33 borrowers, with loans of Rs 500 crore and more, owed it.

In a first, the latest information that was furnished by the RBI to CNN-News18 under the Right to Information (RTI) Act, has disclosed the bank-wise break-up where loans worth more than Rs 100 crore and Rs 500 crore were written off by the banks as of March 31 this year.

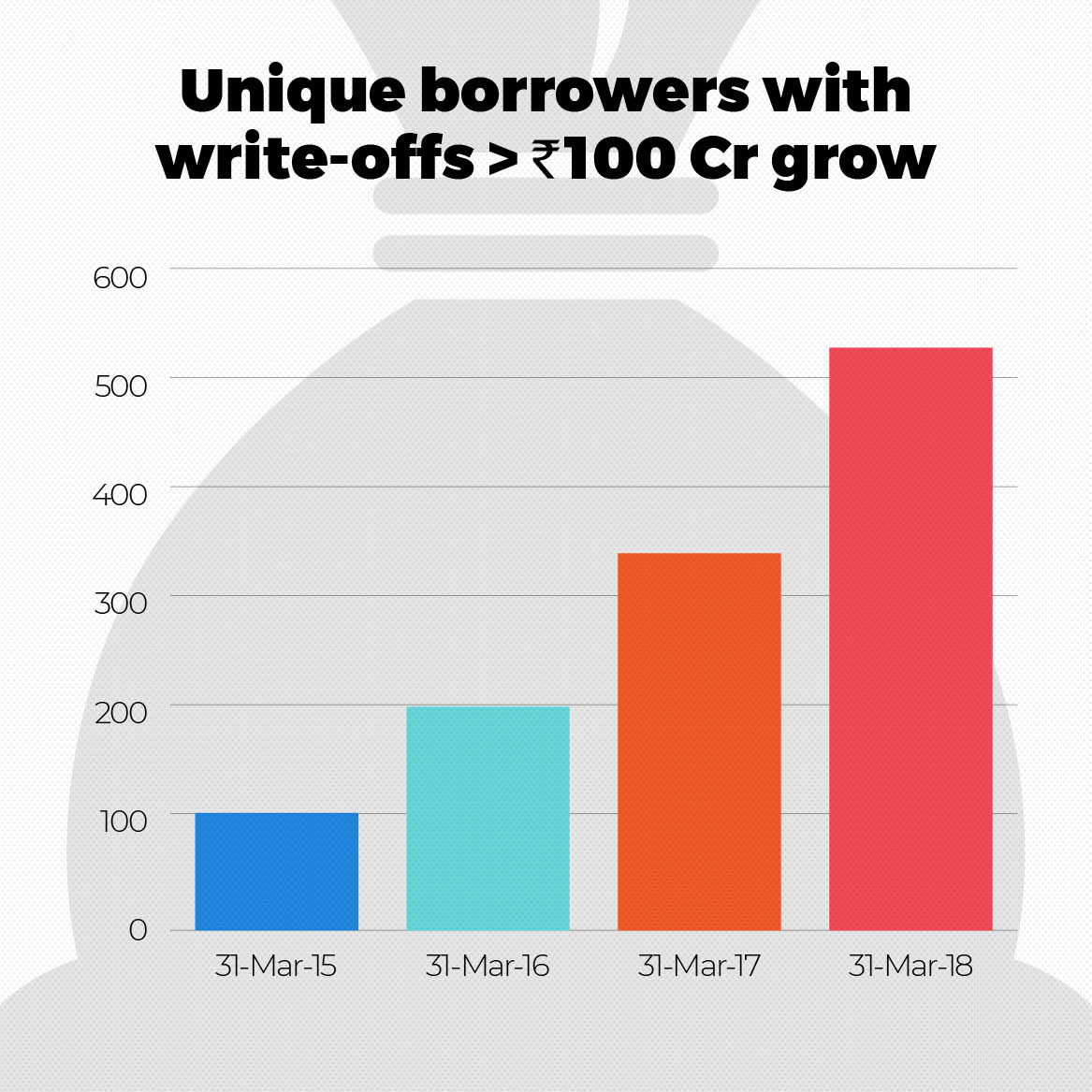

In the last three years, the Indian banking system has lost Rs 1.76 lakh crore on account of non-performing loans of 416 defaulters — each owing Rs 100 crore or more — being written off. On an average, the amount declared as bad loans turns out to be around Rs 424 crore per borrower.

A total of Rs 2.75 lakh crore has been written off for entities that borrowed Rs 100 crore or more from scheduled commercial banks. The latest statistics divulge that Rs 67,600 crore was declared as bad debts for loans of Rs 500 crore and more.

As many as 980 borrowers have been enlisted by the RBI whose debts of more than Rs 100 crore each had to be written off by banks. Of these, 220 accounts – more than one-fifth of the total number – belonged to the SBI. An average of Rs 348 crore was waived off in respect of each such account.

Of the 71 total accounts reported as having defaulted on loans of over and above Rs 500 crore each, the SBI’s share turned out to be 33 – 46% of the total.

Similarly, as of March 31, Punjab National Bank (PNB) had waived off debts of at least Rs 100 crore each in respect of 94 borrowers. The gross amount came out to be Rs 27,024 crore, with an average of Rs 287 crore per account.

The bank also wrote off loans of Rs 500 crore or more for the 12 biggest defaulters, amounting to a total of Rs 9,037 crore.

Thanks to the 88 biggest defaulters in the country, public sector banks virtually lost Rs 1.07 lakh crore in bad debts. On an average, the amount declared as bad loans turns out to be around Rs 1,220 crore per borrower.

While SBI and PNB topped the list among the public sector banks, the IDBI Bank was is at the top among private banks. The IDBI also came third among all the scheduled commercial banks in declaring bad debts of Rs 100 crore or more.

The IDBI had 71 borrowers of Rs 100 crore and more, with a total outstanding of Rs 26,219 crore written off.

Canara Bank, too, had 63 accounts with outstanding of Rs 100 crore and more, and another seven accounts with borrowings of Rs 500 crore and more, in respect of which loans worth Rs 27,382 crore.

The list of borrowers with Rs 100 crore and more as outstanding having been declared as bad loans is followed by Bank of India with 56 accounts, Corporation Bank with 50 accounts, Bank of Baroda with 46 accounts, and Central Bank of India with 45 accounts.

Among the private banks, Axis Bank had 43 such borrowers, followed by ICICI Bank with 37 such accounts.

Similarly, Central Bank of India and Indian Overseas Bank had four defaulters each, owing more than Rs 500 crore when their loans were written off.

The data has been accessed by CNN-News18 through a series of RTI applications following the Supreme Court judgments that directed the RBI to disclose relevant information on non-performing assets (NPAs) and bad debts under the RTI Act.